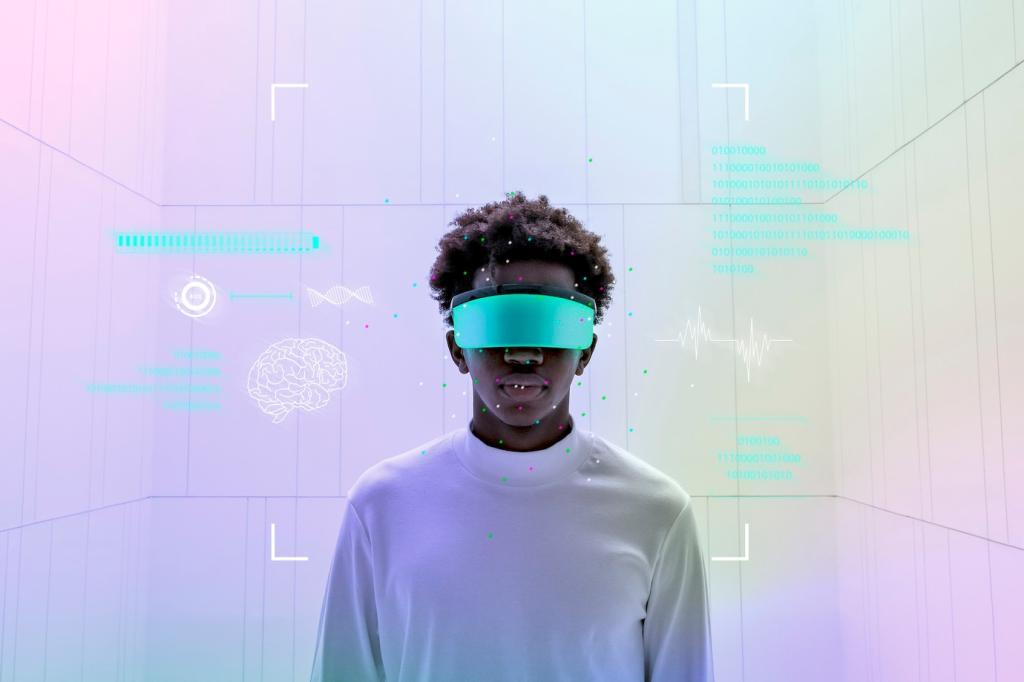

Reimagining Financial Consulting in the Digital Age

Chosen theme: Digital Transformation in Financial Consulting. Welcome to a practical, inspiring journey through the tools, mindsets, and stories reshaping advisory services. If this resonates with your practice, subscribe and share your priorities—we’ll tailor future posts to your toughest transformation questions.

Why Digital Transformation Matters Right Now

A wealth client who opens an account in minutes and tracks investments in real time won’t accept manual forms or delayed reports. Advisory firms that orchestrate instant onboarding, transparent fees, and proactive insights consistently win the next mandate. Comment with your biggest bottleneck—onboarding, reporting, or communication—and we’ll explore practical fixes in an upcoming guide.

Why Digital Transformation Matters Right Now

From suitability checks to ESG disclosures, manual processes invite errors and sleepless nights. Automated controls and traceable workflows reduce risk while freeing experts for higher-value analysis. We’ve seen review cycles cut by days when rules engines flag exceptions early. Subscribe to get our template for mapping regulations to workflows without overwhelming your teams.

Building a Modern Data Stack for Advisory

Advisors thrive when CRM, portfolio, risk, and compliance data flow through a governed lakehouse with clear APIs. That means standardized schemas, metadata, and role-based access that scales from pilot to enterprise. If you’re choosing between tools, comment with your short list and we’ll share evaluation questions that cut through vendor noise.

Data Quality as Habit, Not Project

Quality improves when it becomes a daily ritual: automated checks, anomaly alerts, and clear ownership. One mid-market consultancy boosted client satisfaction after implementing business-led data stewardship, reducing duplicate client records by 63%. Subscribe for our weekly checklist to keep quality rising without adding red tape.

Governance That Enables Rather Than Blocks

Great governance accelerates safe sharing by defining who can use which data, for what purpose, and with what oversight. Clear policies plus lightweight approvals beat blanket restrictions every time. Share your governance win or headache—we’ll feature practical patterns that work in regulated environments without slowing teams to a crawl.

Replace fragile spreadsheets with orchestrated workflows that validate inputs, route approvals, and log every step for audit. A boutique firm cut review time by 45% after deploying automated suitability checks tied to CRM signals. Comment if you want our sample workflow map—you can adapt it to your context in an afternoon.

Automation and AI in Advisory Workflows

Cybersecurity, Privacy, and Trust at the Core

Advisors work across devices, geographies, and partners. Zero trust principles—verify explicitly, use least privilege, assume breach—reduce lateral movement and protect sensitive data. One firm prevented credential stuffing attacks by enforcing phishing-resistant authentication. Comment if you want our zero trust starter checklist tailored for advisory workflows.

Omnichannel Journeys That Actually Connect

Clients move between mobile, email, calls, and portals. Unified messaging, consistent status visibility, and contextual nudges reduce confusion and churn. A bank-advisory team lifted conversion by aligning next best actions across channels. Comment if you want our journey blueprint template to kickstart your design work.

Personalization at Scale Without Creepiness

Use event data and declared preferences to tailor content and timing, not just product pushes. Transparency builds comfort; so does a clear opt-out. We’ll share a personalization playbook if you subscribe—complete with segments, triggers, and measurement tactics grounded in advisory realities.

Measuring What Clients Actually Feel

Go beyond vanity metrics. Combine response times, task completion, and outcome confidence with qualitative feedback to gauge trust. Linking these signals to retention clarifies where to invest. Share the metric you rely on most; we’ll compare approaches and highlight pitfalls to avoid.