Cloud Computing in Financial Consulting Services: Agility with Unshakable Trust

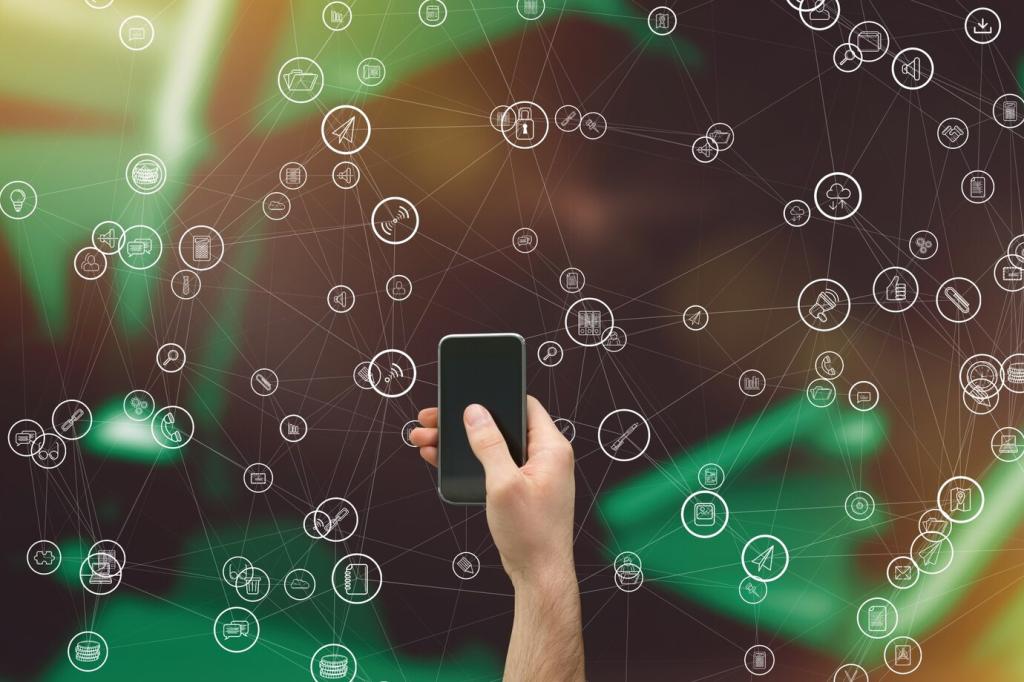

Selected theme: Cloud Computing in Financial Consulting Services. Welcome to a smart, human-centered exploration of how the cloud reshapes advisory work—from modeling and compliance to client storytelling. Join the conversation, share your questions, and subscribe for honest insights you can put to work this quarter.

Why Cloud Matters to Financial Consultants Today

Consulting teams can spin up secure analytics sandboxes in hours, not weeks, iterate financial models collaboratively, and lock approvals with policy-as-code. The combination reduces cycle time while preserving traceability, so partners, auditors, and clients can follow every assumption to its source and challenge it confidently.

Why Cloud Matters to Financial Consultants Today

Boards care about transparency and risk posture, not buzzwords. Cloud-native controls—versioned policies, encryption, and continuous monitoring—translate into reports that answer tough questions clearly. When you demonstrate control objectives live, even skeptical directors lean in, ask better questions, and approve faster execution.

Security and Compliance Foundations Clients Can See

Use strong encryption by default, with centralized keys, rotation schedules, and separation of duties. For sensitive financial datasets, consider customer-managed keys or hardware-backed modules to align with assurance requirements. Document the key lifecycle and access reviews so auditors can verify every control without interpretive guesswork.

Data Architecture that Elevates Financial Modeling

Combine data lakes and warehouses to support flexible exploration with governed, auditable outputs. Use schemas that mirror financial concepts—portfolios, instruments, counterparties—to make models explainable. Maintain versioned datasets so advisors can recreate prior valuations and prove that a recommendation matches the data available at that time.

Data Architecture that Elevates Financial Modeling

Event pipelines stream market ticks, rate changes, and payments activity into lightweight services that trigger alerts or recompute metrics instantly. Advisors can simulate scenarios as events arrive, turning latency into opportunity. With proper throttling and cost guards, you get responsiveness without runaway spend on spiky workloads.

Data Architecture that Elevates Financial Modeling

Implement golden records for customers, accounts, and products, with automated matching and stewardship workflows. Capture lineage across transformations so every figure in a deck links to a definable source. When clients can follow a KPI’s journey, they adopt the recommendation faster and defend it with confidence.

Cloud-Native Analytics and AI for Regulated Finance

Responsible AI in Regulated Contexts

Document model purpose, features, and monitoring thresholds. Use privacy-preserving techniques for sensitive fields and test for drift and bias. Provide human-in-the-loop review for material recommendations. When you can explain why a model changed its mind, stakeholders trust insights rather than fear black-box outcomes.

Client Engagement and Change Management in the Cloud Era

Design dashboards around decisions, not data dumps. Use red–amber–green cues tied to thresholds clients accept, and provide one-click drill-through to assumptions. When leaders can defend the slide track at 7 a.m., they will champion the platform and request broader rollout across functions.