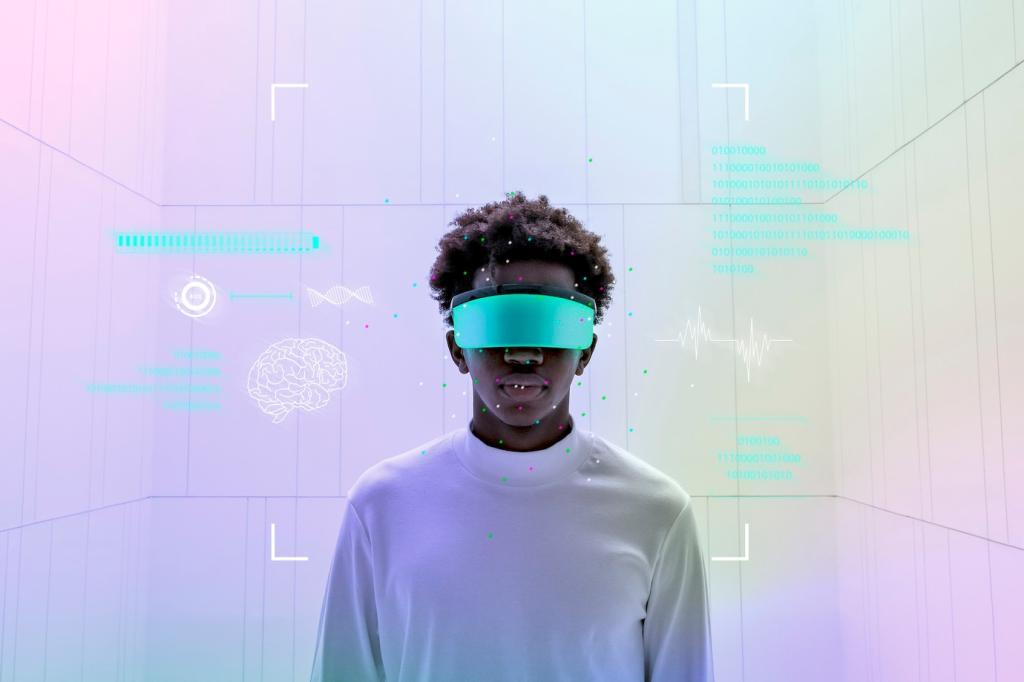

Robo-Advisors: The Future of Financial Consulting

Chosen theme: Robo-Advisors: The Future of Financial Consulting. Welcome to a friendly, forward-looking dive into how algorithms, automation, and human empathy are reshaping personal finance. Settle in, bring your questions, and subscribe for fresh insights every week.

What Robo-Advisors Are and Why They Matter

From Questionnaire to Portfolio

It starts with a simple risk and goals questionnaire, translating your timeline, income needs, and comfort with volatility into a diversified portfolio. That structured pathway reduces guesswork and turns intention into an investable plan. Tell us what surprised you most.

Under the Hood: Algorithms and ETFs

Behind the scenes, algorithms weigh asset classes and rebalance toward targets using low-cost index ETFs. They enforce rules you define—risk level, timeline, and goal priorities—so you are not tempted to react emotionally. Comment if you want a deeper technical explainer.

Human Advisors in a Robo World

Many platforms offer hybrid advice, pairing automation with real people for complex decisions like retirement income or college planning. The robot keeps you on track; the human helps with nuance. Would you prefer fully automated, hybrid, or human-only guidance? Tell us why.

The Momentum Behind Adoption

Lower Fees, Higher Access

By automating portfolio construction and monitoring, robo-advisors reduce overhead and pass savings through lower advisory fees. That cost advantage matters, especially for first-time investors starting small. Would lower fees help you invest more consistently? Join the discussion.

Behavioral Nudges That Stick

Auto-deposits, goal trackers, and gentle alerts nudge good habits and reduce procrastination. Scheduled rebalancing counters performance-chasing, while visual progress bars make long-term goals feel tangible. Which nudge helps you most—automation, reminders, or visuals? Leave a quick reply.

Mobile-First Money Management

Clear dashboards, real-time notifications, and biometric logins create a trusted, always-with-you experience. People can check allocations, boost contributions, or pause deposits while waiting for coffee. Do mobile touchpoints make you invest more often, or simply with more confidence?

Risk, Regulation, and Responsibility

KYC, Suitability, and Guardrails

Know-your-customer and suitability assessments help match portfolios to your goals and risk tolerance. Guardrails, like allocation bands and diversification, limit drift. If you have ever adjusted answers to chase returns, pause and reconsider. Share how you keep your settings honest.

A Day in the Life with a Robo-Advisor

Before work, Maya opens her app, sees contributions scheduled, and reads a brief, jargon-free summary of performance versus her goal. No charts shouting at her—just context and next steps. What would your ideal morning snapshot include? Suggest it below.

A Day in the Life with a Robo-Advisor

While Maya handles a busy ward, the system nudges her portfolio back to target weights when drift crosses thresholds. No emotional decisions, just measured adjustments. Have you ever set rules that saved you from a hasty trade? Share your win.

Designing Your Robo-Ready Plan

Define one goal per account when possible—emergency fund, home, retirement—so the algorithm can set a coherent risk level and glide path. Revisit your risk score after life events. What changed your score recently—income shift, family, or market news?

Designing Your Robo-Ready Plan

Tax-loss harvesting, asset location, and mindful withdrawal order can add quiet value. Understand the basics—even if the system automates them—so you recognize when results match expectations. Which tax feature confuses you most? Ask below and we’ll unpack it next issue.

The Road Ahead: Where Robo-Advisors Go Next

Hyper-Personalization Through Better Data

Advances in data modeling can tailor allocations to income volatility, career stage, and even paycheck timing. Done responsibly, this keeps plans realistic and resilient. Which personal data would you willingly share for better advice, and where would you draw the line?

ESG and Values-Driven Automation

Robo-advisors increasingly offer filters for climate, labor standards, or governance preferences. Expect clearer impact metrics and trade-off disclosures. Would you accept slightly higher fees for value alignment, or prioritize pure cost? Discuss your approach and help others find their balance.

Advice Everywhere: Embedded Finance

Financial guidance will surface inside payroll apps, small-business tools, and everyday banking. Micro-suggestions—roundups, paycheck rules, and seasonal nudges—will feel natural. Where would you want advice to appear next—email, messaging, or smartwatches? Share to shape our upcoming experiments.