Immersive Finance: Virtual and Augmented Reality in Consulting

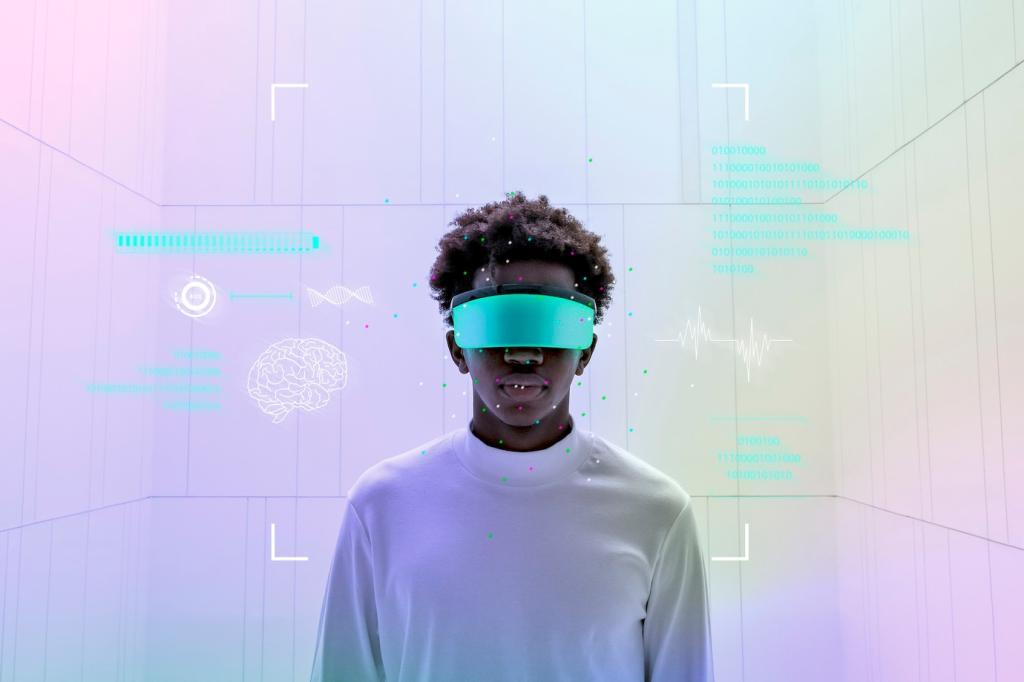

Chosen theme: Virtual and Augmented Reality in Financial Consulting. Step into an advisory world where numbers become places you can visit, risks you can feel, and strategies you can explore together. Join us, share your questions, and subscribe to follow the future of client trust, clarity, and collaboration.

The Fundamentals of VR and AR for Advisors

01

Imagine meeting clients inside a private, branded virtual room, reviewing portfolios while standing beside three-dimensional cash flow timelines. Presence builds rapport faster than a screen share, and eye contact enhances trust. Set expectations, obtain consent, and guide clients through scenarios that feel real enough to remember, yet safe enough to explore together.

02

With a quick scan of printed statements or a desktop view through smart glasses, augmented overlays highlight fees, risk bands, and tax lots in context. Arrows reveal what changed since last quarter, while color-coded annotations explain why. Clients interact naturally, asking better questions because the information literally appears where their attention already lives.

03

A young couple debated a fixed versus variable mortgage. Using AR, their advisor projected neighborhood price trends onto a kitchen table map, then layered monthly payment bands as floating rings. Seeing how rate shifts squeezed their monthly cushion made the trade-offs visceral. They chose confidently, and later emailed saying, “We finally felt the numbers.”

Communicating Risk and Strategy with Presence

Turning volatility into felt experience

In VR, a calm market looks like a wide, steady corridor; volatility narrows that path and quickens ambient motion. Clients notice how emergency funds widen the corridor again. When emotions spike, advisors slow the environment, anchoring behavior. Invite readers: Would this help your family talk calmly about risk? Tell us how you’d visualize it.

From pie charts to spatial portfolios

Instead of flat pies, clients walk through diversified rooms: equities feel airy and dynamic, bonds steady and grounded, alternatives tucked behind a resilience wall. Allocation shifts physically resize spaces, making concentration risks unmistakable. Ask your clients which room feels crowded. Encourage comments about which spatial cues best reflect their own goals and comfort levels.

Ethics and transparency inside headsets

Headsets can enchant, so fairness matters. Advisors should disclose what is simulated, the assumptions underneath, and potential blind spots. Tooltips can reveal Monte Carlo inputs with one glance. Clear, consent-driven design builds credibility. Would you appreciate a toggle that shows a raw, unpolished view? Subscribe for updates on ethical templates and best practices.

Training, Compliance, and Consistency

Regulatory drills in simulated branches

Trainees practice suitability conversations with lifelike avatars who ask tough, emotional questions about loss. Branch policies appear contextually on walls, and wrong turns rewind instantly. Feedback arrives as heatmaps of attention and listening time. Interested in role-play libraries for difficult scenarios? Share which conversations you’d rehearse first, and we’ll craft example scripts.

Privacy-by-design architectures

Financial data should never leak through novel sensors. That means local processing for biometrics, encrypted session streams, and per-feature permissions that clients can revoke instantly. Clear data flow maps help compliance teams sleep better. Want a checklist for AR/VR vendor due diligence? Subscribe to receive a practical, regulator-friendly template you can adapt.

Audit trails you can replay

Immersive sessions can produce synchronized transcripts, gesture timelines, and artifact states. Compliance can review exactly which projection clients saw when a decision was made. Transparent logs protect both sides. Imagine attaching a short replay to an e-signature. Would that strengthen your documentation? Comment with your current process and we’ll suggest incremental upgrades.

Implementation Roadmap for Your Firm

Choose one advisory journey—like annual reviews for pre-retirees—and build a concise immersive script. Define success as fewer follow-up emails and faster decisions. Collect qualitative quotes and quantitative time savings. If you’ve run pilots before, share what stalled adoption, and we’ll offer ideas to unblock procurement, training, and security approvals.

Implementation Roadmap for Your Firm

AR overlays shine only when connected to live CRM notes, portfolio analytics, and document vaults. Use APIs to populate context, and compliance tags to control visibility. Start with read-only exposure, then expand carefully. Tell us your current stack, and we’ll map a phased integration plan prioritizing stability, resilience, and minimal disruption.

KPI framework for immersive advisory

Define metrics before headsets arrive: comprehension scores, decision latency, plan adherence, and referral rates. Add advisor metrics like prepared time and rework. Include compliance exceptions reduced. Share your top three KPIs below, and we’ll publish benchmark ranges to help your firm compare progress without exposing sensitive strategy details.

Experiment design that respects clients

Run A/B tests ethically: half of reviews in VR or AR, half with enhanced traditional tools. Provide opt-outs, equal service quality, and clear consent. Survey emotional clarity and confidence immediately after sessions. Curious about sample sizes and statistical power for small books? Subscribe for our calculator and case-based guidance.

Crunching the payback math

Add up shorter meeting times, higher conversion, and fewer clarification emails. Subtract hardware, software, training, and integration costs. Consider intangible lifts like advisor satisfaction and brand differentiation. Want a spreadsheet template with default assumptions? Comment “ROI” and we’ll share a practical model to start a disciplined internal discussion.

Designing for Comfort, Clarity, and Inclusion

Keep movement user-controlled, with teleport options and minimal acceleration. Offer seated modes and scheduled breaks. Design for fifteen-minute arcs that deliver one clear insight each. If clients feel queasy, the narrative collapses. Tell us your preferred session length, and we’ll adjust our example flows and pacing recommendations accordingly.

Designing for Comfort, Clarity, and Inclusion

Use depth, scale, and lighting to prioritize information. Important thresholds sit at eye level; background assumptions live dimly behind. Animations should be meaningful, not flashy. Haptics can underline key moments. Which metaphor clarifies asset allocation best for your audience—rooms, landscapes, or sculptures? Share your pick to influence our next design kit.

What’s Next: Spatial Finance and Intelligent Agents

Expect immersive retirement planning, small-business cash flow theaters, and collaborative estate mapping with families across continents. VR becomes the new conference room, AR the new highlighter. We’ll track live deployments and report candid lessons. Subscribe to our digest to catch monthly breakthroughs without drowning in hype or scattered press releases.

What’s Next: Spatial Finance and Intelligent Agents

Instead of tickers, watch liquidity pools ebb and flow as translucent currents, with alerts pulsing gently at risk thresholds. Advisors pin watchlists to physical surfaces, discussing moves while walking. Clients finally see how signals relate. Would this clarity calm or excite your decisions? Tell us, and we’ll prototype responsibly paced visual rhythms.